How Location Intelligence Provides a Compass for Commercial Real Estate

Headwinds Continue to Buffet Commercial Real Estate

Persistent economic uncertainty, rising interest rates, and recessionary fears have created challenging conditions in commercial real estate. As the bad headlines accumulate, developers and investors need solutions to navigate the storm.

Luckily, innovation in data and location intelligence has been rapidly occurring in parallel, offering a valuable lifeline for CRE professionals. In fact, geospatial data and location-based insights are not only helping these professionals survive tough market conditions, but actually thrive and grow their business.

Location intelligence gives CRE developers and investors the information needed to understand the dynamically changing market, and what it means for the properties in their portfolios. It provides data about what is happening in a specific location, as well as analysis tools to identify why it’s happening. What’s more, the spatial aspect of location intelligence makes it easy to visualize market conditions within a local context, and share those insights with stakeholders or the general public. With geospatial data and analytics, CRE professionals can better navigate risk in an uncertain market to ultimately drive their business forward.

Minimizing Risk and Optimizing Growth with Robust Spatial Analytics

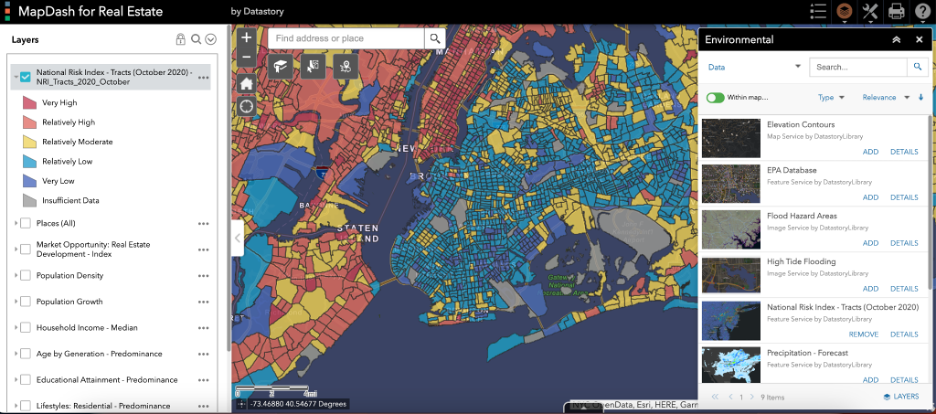

Understanding real estate opportunity and risk requires layering multiple datasets together to see how socioeconomic, property, and environmental factors impact an area.

In today's tumultuous real estate landscape, minimizing risk is often the highest priority for CRE professionals. Location intelligence equips professionals with spatial analytics to inform decisions and reduce exposure. For example, geospatial data enables the CRE industry to identify fast-growing - yet stable - markets primed for new projects based on population, employment, and permitting trends. This granular market analysis uncovers hidden submarket opportunities and quantifies asset valuations informed by hyperlocal conditions, workflows that are not possible without accurate and up-to-date data.

MapDash’s pre-configured data layers include a suite of environmental datasets so CRE professionals can understand climate risks associated with new and existing properties.

Also top of mind for developers and investors is understanding the climate and natural hazard risk exposure of properties in their portfolios. Climate risk analysis ensures long-term viability of investment decisions, and is increasingly important for tenants as well. Mapping out flood zones, protected wetlands, elevation, and other important environmental factors helps CRE professionals understand the suitability of a site, and develop hazard mitigation tactics for properties they manage. Spatial analysis of these maps and data further informs decision-making, empowering investors and developers to conduct “what-if” analyses and understand how our changing climate may impact business.

Cost-Effective Location Intelligence with MapDash

Data-driven decision making becomes even more critical in difficult times, yet many advanced analytics solutions come with high price tags and resource demands. CRE professionals are often faced with the time-consuming task of sourcing and manipulating open source datasets, or else need to invest large sums of money to purchase them from a third-party. Beyond just acquiring the data that is the backbone of location intelligence, investors and developers need to learn how to analyze that data in a geographic information systems (GIS) tool, which is not always straightforward.

Datastory’s MapDash is a cost-effective and pre-configured location intelligence platform that delivers strategic insights with a quick time-to-value. MapDash places all of the relevant data right at your fingertips so you can analyze market risk and opportunity simply and accurately. With an easy-to-use mapping interface, CRE professionals can search for a specific property or market, toggle on and off the data they need to see, and conduct spatial analytics to derive actionable insights for decision-making. Datastory ensures that MapDash’s data layers are always authoritative and up-to-date so investors and developers can stay on top of market trends.

MapDash can instantly transform spatial analysis results into informative and visually compelling reports to share key takeaways with stakeholders.

With MapDash, commercial real estate professionals can leverage built-in data layers to:

● assess climate risk across portfolios;

● identify best geographic markets to deploy capital;

● analyze trends in development momentum;

● uncover hidden opportunities in submarkets;

● guide investments based on econometric market health;

● and perform other location-based analytics and workflows.

User-friendly dashboards bring spatial context to demographic, employment, real estate, and other data at national, regional, and hyperlocal levels, making it easier than ever to share the deep insights gleaned with all stakeholders. With MapDash, sophisticated analytics become easily accessible to all professionals, regardless of technical expertise.

The Road Ahead

As economic uncertainty persists, having an affordable location intelligence advantage is key. MapDash provides the commercial real estate industry with the data and tools needed to develop resilient strategies grounded in geographic and market realities, without the hassle of sourcing, cleaning, and maintaining a robust data library.

Now is the time to leverage the power of place. Request a demo of MapDash tailored to your specific portfolio needs today.